In a drive to modernize, the government began to adopt a policy of using electronic documentation.

A legal framework has been created to accommodate the changes. Regulatory acts have created

favourable legal conditions for the formation of specialized communications service providers,

organizing systems of electronic documentation in the taxation sector. Their work is regulated

by the law. High demands are placed on data protection, using special block cipher algorithms.

There are detailed regulations on data exchange, as well as the formats for incoming and outgoing

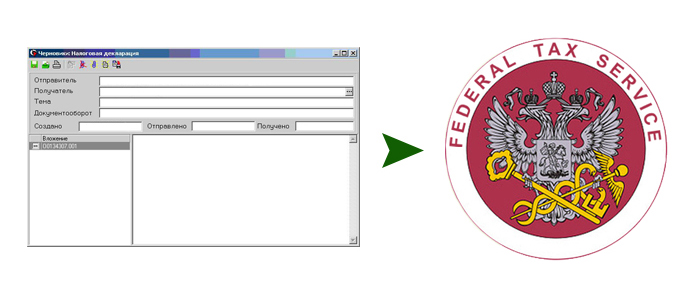

communications. The software developed is a system for filling out tax accounting forms electronically.

The end users include all kinds of business entities, companies and individual entrepreneurs. The

interface is based on an email client with added encryption functions. The application supports document

import and batch processing.

The software performs the following tasks:

- Submission and correction of statements and reports without loss of time in queues

- Obtaining statements from registries and other documents from tax offices online

- Sending correspondences instantly

The system consists of a client module (workplaces in both the company's office and for the

tax authorities), a server module and technical support module.

Client module

The end user installs a special piece of software for transferring the completed tax

documentation as regular files. Benefits of the software:

- Selecting form a list of tax authorities

- An intuitive interface resembling an email client (group into Inbox, Drafts, Sent etc.)

- Ability to sort messages by theme, subject or status

- Sorting inquiries by status using colour and graphics

- Tracking the current status of an inquiry

- Reliable data protection through a certified encryption process, provided automatically through the server unit

The client module on the tax authorities' side takes the form of a desktop application, allowing personnel

to handle incoming communications and download data to the internal system of the Federal Tax Service for

further use. In case of an error, an operator will be alerted so that any inaccuracies can be corrected

manually. An automated system processes responses, sending notifications to the relevant taxpayers.

Server module

The functionality includes:

- Certification authority

- Processing correspondence between the organization and the tax authority

- Acting as coordinator of public key infrastructure (PKI)

- Providing software licensing certificates in the event of expiry or upgrade

- Certification revocation list (CRL) for PKI

Technical support module

For efficient correction of internal errors, a specialist department is

required to carry out specific tasks. For such cases, the following are provided:

- The ability to view and analyse the registry of messages passing through the system

- Filtering by date, time, tax authority involved, and taxpayer using the service

- Labelling the condition of specific correspondences with colour and graphics

The specified constituent elements of the system have undergone debugging and load

testing to increase the speed of processing incoming and outgoing correspondences.

2002–2026

2002–2026