The system includes the following components:

- Administrative interface for bank registration

- A high performance server

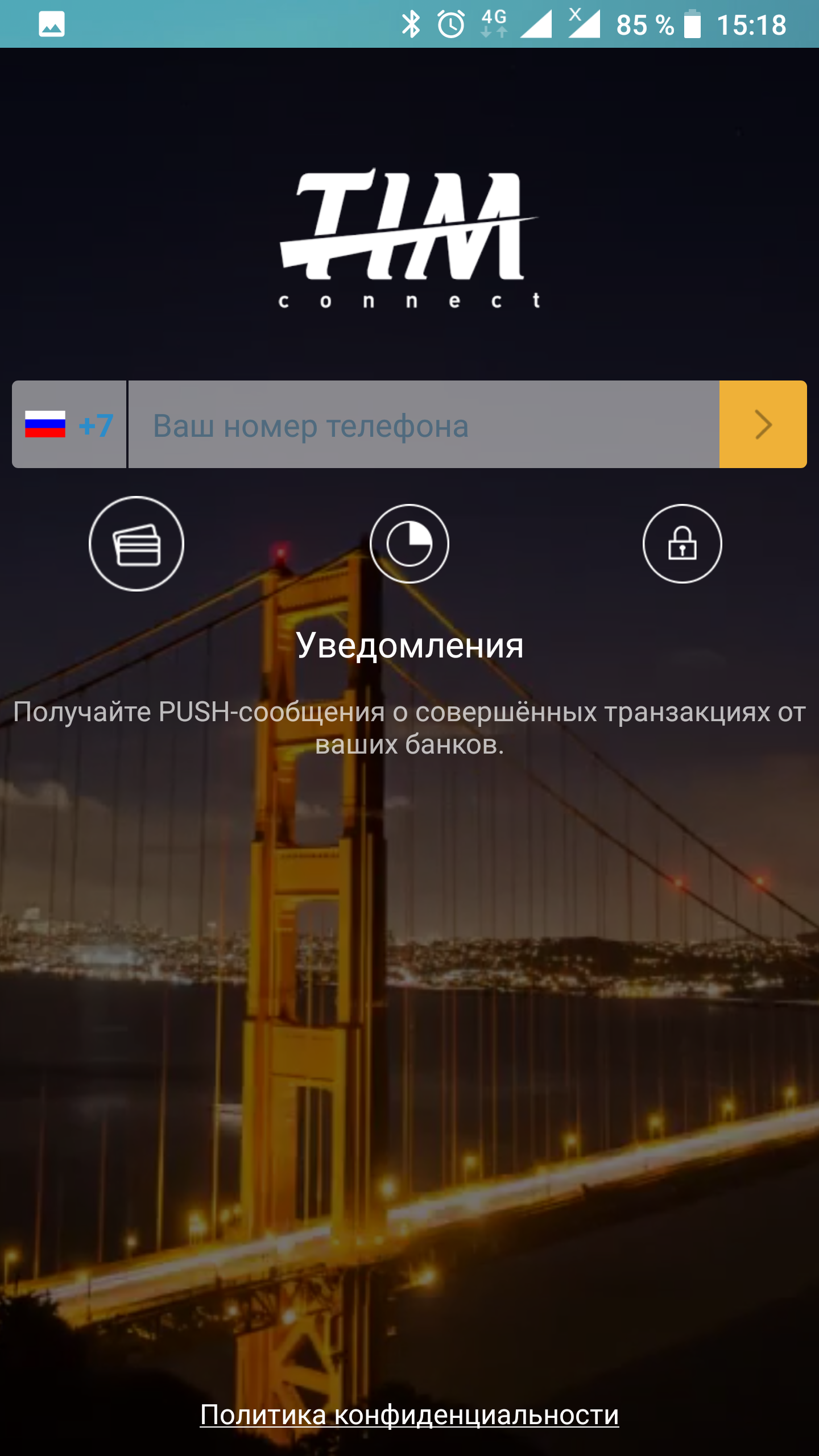

- API for receiving messages for mobile applications via push notifications for iOS, Android and Windows Phone

- SMS gateway to connect banks via HTTPS and SMPP protocols

- Mobile applications

Principle of operation

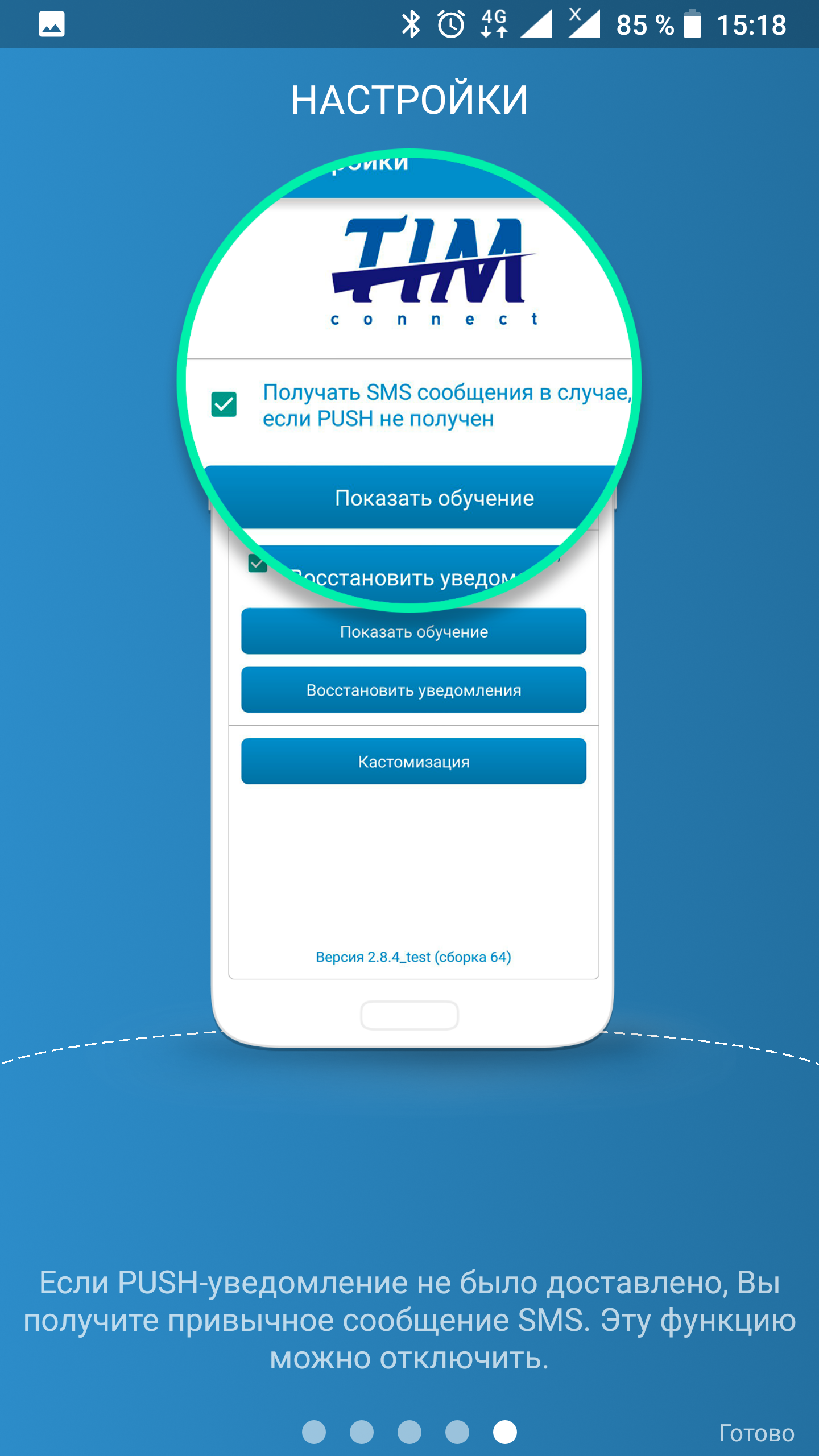

The bank sends the information to a server, which then relays the information as a push

notification to the customer. This service is activated automatically as soon as the customer

downloads the relevant app. An SMS message will be sent in following situations:

- The push notification is not delivered

- It remains unread for a specified amount of time

- The customer's phone does not support push notifications

The banks are not responsible for sending SMS messages in the event of non-delivery of push notifications.

The software architecture contains three main elements:

- The first is responsible for delivering SMS messages

- The second is responsible for delivery of push notifications

- The third relates to the client service element dealing with banks utilizing the service

The service was developed as a response to market conditions, with the mobile network providers

increasing tariffs almost immediately after the law was passed requiring banks to send SMS

notifications to customers. The service is offered as an out-of-the-box solution for banks,

and is provided on a per-use basis. No profit is made where SMS messages are sent to customers,

but with the number of mobile application downloads already over 100,000 there is clearly huge

demand for the service from bank customers. Though they are not directly paying for the SMS

messages, the ease of use of push notifications is a key factor in the early success of the

newly established service. Sixty percent of push notifications are read immediately on

delivery, with the remaining 40% duplicated as SMS messages.

Market penetration is a key factor for the success of the service in an industry where the

most popular app has an 11% market reach. To address this, a parallel service for spending

analytics using information from banks has been developed to entice customers to download the

application. This provides customers with a budgeting service that:

- Requires no manual data entry

- Can show accounts, loans and deposits

- Updates in real time

A further reason this

extra feature has been provided is to provide adequate competition against in-house push

notification solutions currently under development by major banks.

2002–2026

2002–2026